An unfavorable temporary book/tax difference generates a deferred tax asset. – Unfavorable temporary book/tax differences can generate deferred tax assets, leading to intricate accounting and tax implications. This article delves into the concept, impact, and accounting treatment of such differences, shedding light on their significance in financial reporting and tax compliance.

An unfavorable temporary book/tax difference generates a deferred tax asset. Speaking of old things, have you ever heard of an old book or a old book ? Regardless, coming back to the topic, an unfavorable temporary book/tax difference generates a deferred tax asset.

Unfavorable Temporary Book/Tax Difference

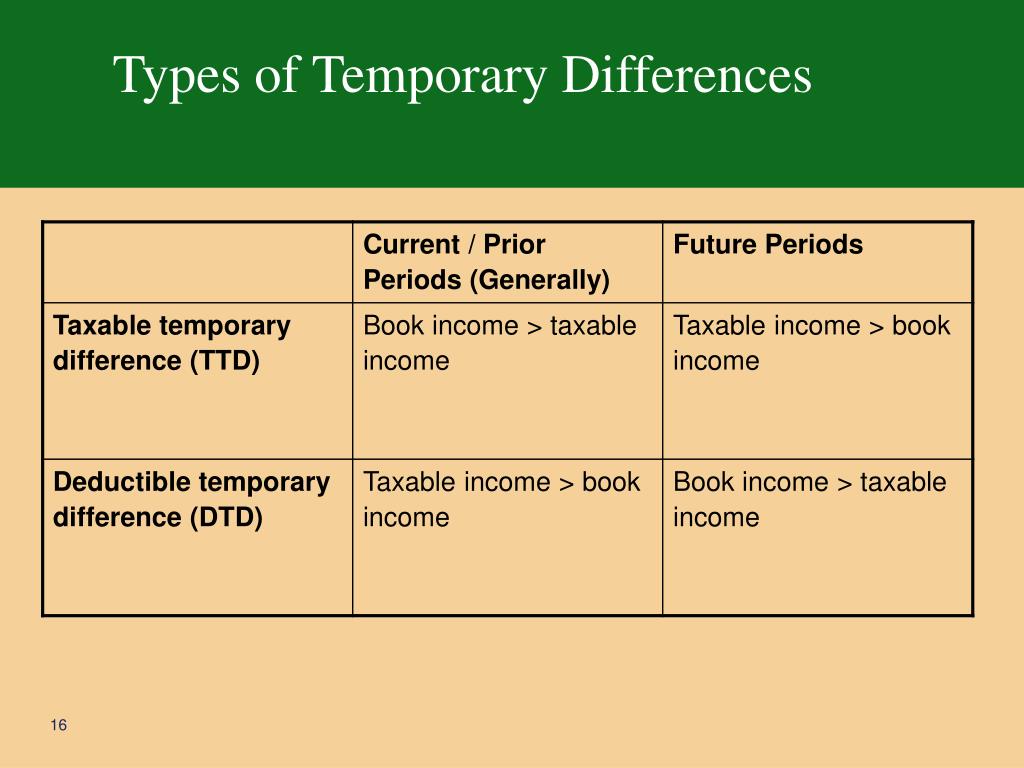

An unfavorable temporary book/tax difference arises when the book value of an asset or liability differs from its tax basis, resulting in a higher taxable income than the reported income on the financial statements. This can occur due to various transactions, such as depreciation expenses, warranty accruals, or the recognition of revenue for tax purposes in a different period than for book purposes.

An unfavorable temporary book/tax difference generates a deferred tax asset, which is a valuable asset for a company. In the book An Ode to Us , the author discusses how a deferred tax asset can be used to improve a company’s financial performance.

The book provides a comprehensive overview of deferred tax assets and how they can be used to benefit a company. An unfavorable temporary book/tax difference generates a deferred tax asset, which can be a valuable asset for a company.

Impact on Deferred Tax Asset

An unfavorable temporary book/tax difference creates a deferred tax asset. This asset represents the future tax savings that will result from the reversal of the temporary difference in future periods. The deferred tax asset is calculated as the difference between the book value and tax basis of the asset or liability, multiplied by the applicable tax rate.The

When an unfavorable temporary book/tax difference generates a deferred tax asset, it’s like getting a tax break for an an isolated incident book that you can’t cash in right away. But don’t worry, the tax savings will eventually come your way, just like the plot twist in an isolated incident book.

deferred tax asset is reported on the balance sheet as an asset. It reduces the company’s current tax liability and increases its future tax liability.

An unfavorable temporary book/tax difference generates a deferred tax asset, which means that the company has overpaid taxes in the past and will receive a tax refund in the future. This is like having an open book on your taxes, where you can see exactly what you owe and what you will get back.

An unfavorable temporary book/tax difference can be a valuable asset for a company, as it can provide a source of future cash flow.

Accounting Treatment, An unfavorable temporary book/tax difference generates a deferred tax asset.

The accounting entries to record an unfavorable temporary book/tax difference involve:

- Debiting the asset or liability account for the difference between the book value and tax basis.

- Crediting the deferred tax asset account for the same amount.

These entries increase the book value of the asset or liability and create a deferred tax asset.

Unfavorable temporary book/tax differences can generate deferred tax assets. Just like how the An Ocean of Minutes book review mentioned, sometimes it’s worth it to wait for something better. In this case, waiting for the tax benefits to kick in.

An unfavorable temporary book/tax difference generates a deferred tax asset, which can be used to reduce future tax liability.

Tax Implications

An unfavorable temporary book/tax difference affects the taxpayer’s current and future tax liability. The higher taxable income in the current period results in higher current taxes. However, the deferred tax asset provides a future tax savings when the temporary difference reverses.The

An unfavorable temporary book/tax difference generates a deferred tax asset, which is a potential future tax benefit. This is like when you find an original green book at a garage sale for $5 and sell it on eBay for $1,000. You have a deferred tax asset of $995, which you will have to pay taxes on when you sell the book.

However, you can use this asset to offset future tax liabilities, reducing your overall tax bill.

IRS may audit the taxpayer’s tax return to verify the validity of the temporary difference. If the IRS disallows the temporary difference, the taxpayer may have to pay additional taxes and penalties.

An unfavorable temporary book/tax difference generates a deferred tax asset. Speaking of books, have you heard about the an ordinary life book nawazuddin siddiqui ? It’s a great read! Back to our topic, this deferred tax asset will be amortized over the life of the temporary difference, resulting in an increase in taxable income and a decrease in the deferred tax asset.

Examples and Illustrations

Examples of unfavorable temporary book/tax differences include:

Depreciation expenses

When an asset is depreciated more quickly for tax purposes than for book purposes, it creates an unfavorable temporary book/tax difference.

Warranty accruals

When a company accrues for warranties for financial reporting purposes but not for tax purposes, it creates an unfavorable temporary book/tax difference.

Revenue recognition

When an unfavorable temporary book/tax difference generates a deferred tax asset, it means that the company has recorded a higher expense for tax purposes than it has for book purposes. This can create a timing difference between the recognition of the expense for tax purposes and the recognition of the expense for book purposes.

An ocean of animals book can help you learn more about this topic. The deferred tax asset will be recognized on the balance sheet as an asset and will be amortized over the period in which the timing difference reverses.

This will result in a reduction of the deferred tax asset and an increase in the company’s taxable income.

When revenue is recognized for tax purposes in a different period than for book purposes, it creates an unfavorable temporary book/tax difference.

Ultimate Conclusion

Understanding unfavorable temporary book/tax differences is crucial for accurate financial reporting and tax planning. By grasping the concepts discussed in this article, individuals and businesses can navigate these differences effectively, ensuring compliance and optimizing their financial position.

FAQ Resource: An Unfavorable Temporary Book/tax Difference Generates A Deferred Tax Asset.

What is an unfavorable temporary book/tax difference?

It occurs when a deductible expense is recognized for tax purposes before it is recognized for financial reporting purposes, resulting in higher taxable income than book income.

How does an unfavorable temporary book/tax difference impact the deferred tax asset?

It increases the deferred tax asset, as the higher taxable income leads to a lower current tax liability and a higher future tax liability.

What are the accounting entries to record an unfavorable temporary book/tax difference?

Debit deferred tax asset, credit income tax payable (for the current tax effect) and credit deferred tax expense (for the future tax effect).