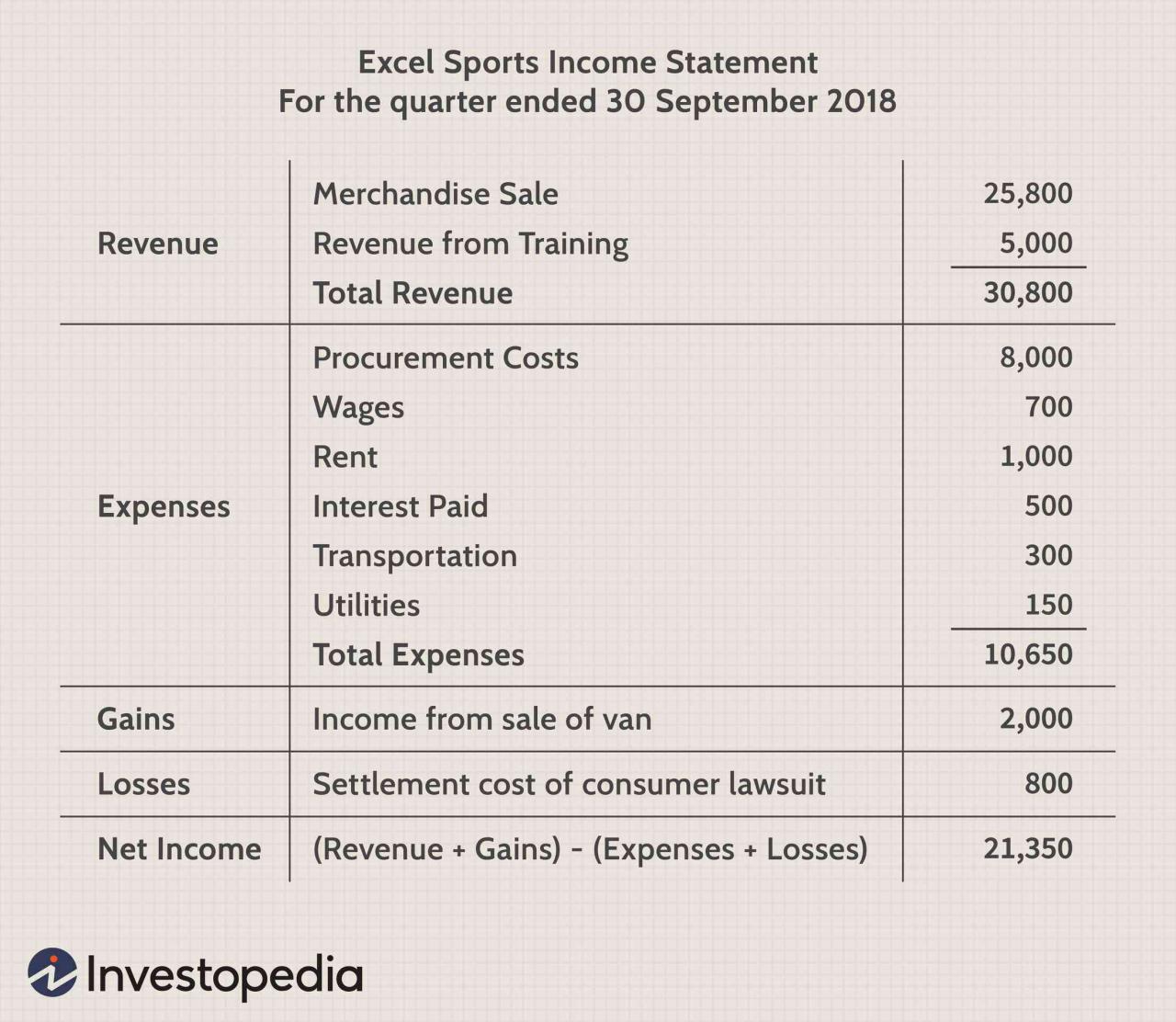

Mastering Financial Reporting for Associations: A Comprehensive Guide

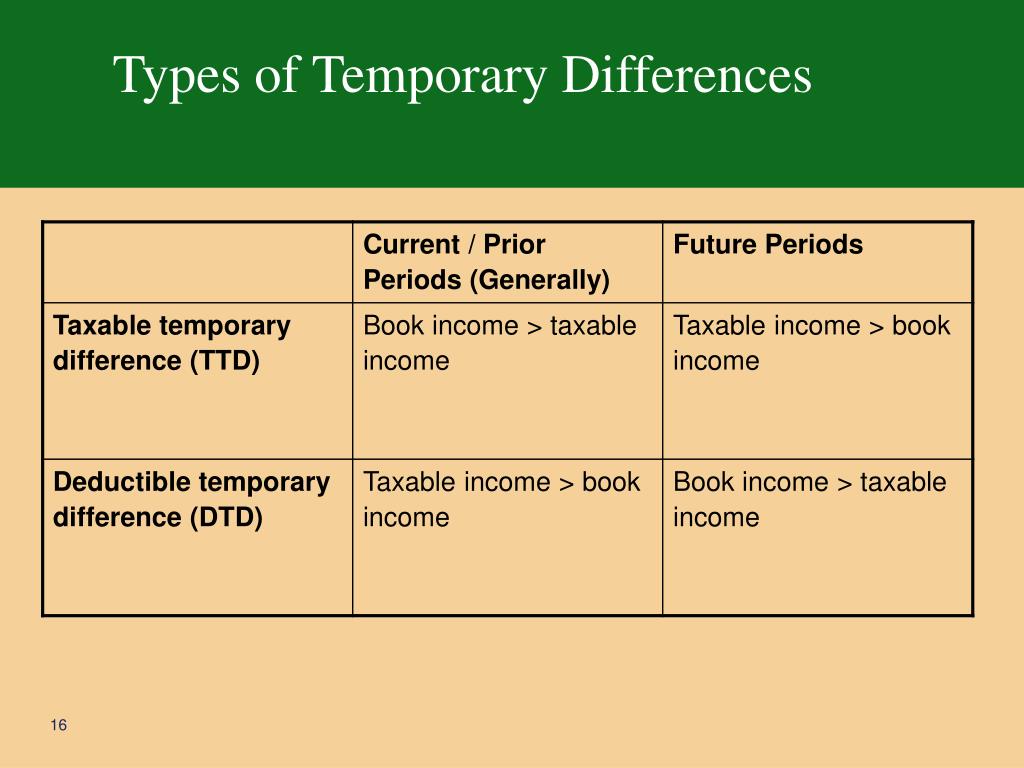

Introduction: How To Write A Financial Report For An Association How to write a financial report for an association – A financial report for an association is a crucial document that provides a comprehensive overview of the organization’s financial performance and health. It plays a vital role in informing members, stakeholders, and regulatory bodies about … Read more